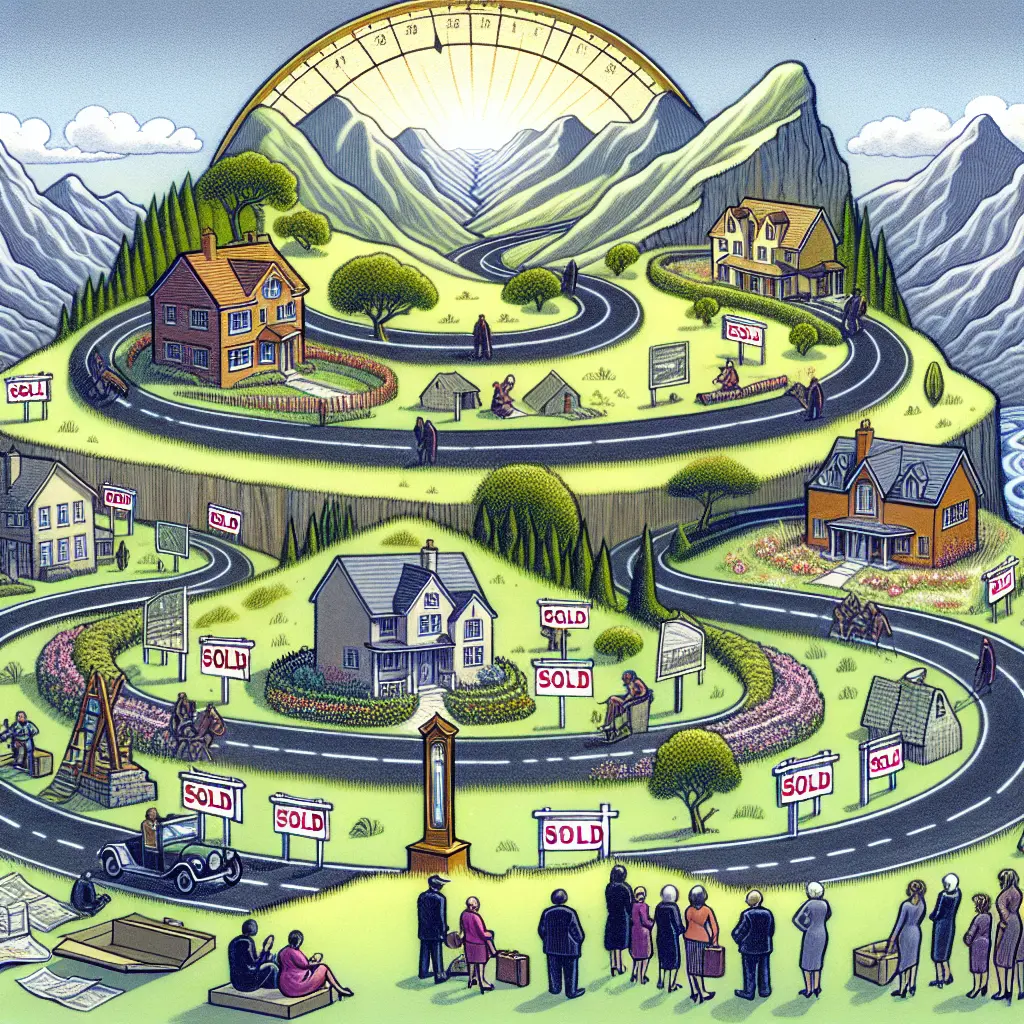

Navigating the ever-changing landscape of real estate requires a keen understanding of real estate market cycles. For investors and enthusiasts alike, mastering these cycles is crucial for making informed decisions and optimizing investment returns. Real estate market cycles encompass a series of phases—expansion, peak, contraction, and recovery—that repeat over time, influenced by various economic factors. Recognizing these cycles allows investors to tailor their real estate investment strategies, tapping into property market trends and maximizing opportunities during each phase.

The Anatomy of Real Estate Market Cycles

Real estate market cycles are influenced by factors such as interest rates, employment levels, and consumer confidence. For example, California's recent initiative urging schools to construct housing for teachers and students reflects the expansion phase, where demand for housing is high due to population growth and increased employment opportunities in education sectors. This demand often leads to a real estate boom, characterized by rising property values and increased construction activities source: LA Times.

Conversely, exuberant market activity, such as a Hawthorn home selling for over $1 million above its reserve price, can signal the peak phase of the cycle, where prices hit unsustainable highs and may precede a market correction or bust. Understanding these dynamics is essential for identifying potential housing bubble indicators source: The Age.

Navigating Expansion and Peak Phases

Expansion phases offer prime opportunities for real estate investment strategies focused on growth and acquisition. Investors can capitalize on property market trends by purchasing undervalued properties or those in emerging neighborhoods. As seen in Dubai's current economic boom, regions experiencing rapid growth can offer lucrative opportunities. However, savvy investors must also prepare for the peak by developing real estate downturn strategies to mitigate risks associated with overvaluation and potential market corrections source: Gulf News.

To effectively navigate these phases, thorough housing market analysis is crucial. This involves monitoring key metrics such as inventory levels, price-to-income ratios, and loan-to-value ratios. By recognizing these indicators, investors can adjust their real estate market timing, ensuring strategic entry and exit points that align with their financial goals.

Preparing for Contraction and Recovery Phases

The contraction phase often follows a market peak, characterized by declining property values and reduced demand. Although challenging, this period offers unique opportunities for those prepared with sound real estate downturn strategies. Investors should focus on preserving capital and maintaining liquidity during contractions, allowing them to seize opportunities as they arise.

Consider the case of Seritage Growth Properties (NYSE: SRG), which has faced significant challenges recently. The Rosen Law Firm has urged stockholders with large losses to contact them for information about their rights, highlighting the importance of staying informed and proactive during downturns source: Reuters.

Recovery phases signify gradual stabilization, where property values begin to rise again. Investors who have conducted comprehensive property market analysis during contractions can benefit from buying low and selling high as the market rebounds.

Real Estate Cycle Phases in Action

A practical approach to understanding real estate cycles is examining specific case studies. Following the 2008 financial crisis, many regions experienced prolonged contraction phases. Investors who recognized housing bubble indicators early on implemented effective strategies that enabled them to thrive during subsequent recovery phases.

Personal stories shared in articles about managing debt highlight the importance of financial preparedness during economic downturns. Learning from past experiences can equip investors with valuable property investment tips crucial for future success source: MarketWatch.

Integrating Astrological Insights

While traditional economic indicators are vital in housing market analysis, some investors consider unconventional approaches like astrological predictions. Weekly money horoscopes have gained popularity among certain demographics, offering unique perspectives on financial planning and investment timing. Whether or not one subscribes to these insights, they underscore the diverse strategies individuals use to navigate real estate economic cycles source: Astrology.com.

Conclusion

Understanding real estate cycles is essential for investors aiming to maximize opportunities across varying market conditions. By analyzing property market trends and recognizing housing market cycles, one can develop robust strategies tailored to each phase of the cycle. As we continue to witness dynamic shifts in global real estate markets—from California's educational housing initiatives to Dubai's booming economy—staying informed and adaptable remains paramount.

Incorporating diverse perspectives, including personal finance lessons and alternative insights like astrology, further enriches our understanding of this complex industry. As you navigate your real estate journey, remember that informed decisions are your greatest asset in optimizing investment outcomes amidst ever-changing market landscapes.

Consider sharing your experiences or insights in the comments below. How have you navigated real estate cycles in the past? What strategies have been most effective for you? Engaging with this community can provide additional perspectives and support as you refine your investment strategies.

Thank you for joining me on this exploration of real estate market cycles. Here's to informed decisions and prosperous investments!

Author: Felicia Green